Competing take-overs in Kenya are regulated by the Capital Markets (Take-overs and Mergers) Regulations, 2002 (the Regulations). The Regulations provide for rules to ensure equitable treatment of shareholders, particularly minorities during take-over and mergers for a fair and transparent process. The Regulations additionally promote market integrity by providing a framework for regulatory oversight by the Capital Markets Authority in scenarios where multiple entities seek to acquire control of the same target company. Accordingly, this article shall delve into the procedures applicable in relation to competing take-overs for listed companies in Kenya. This has been recently evidenced by the take-over offer and competing take-over offers in 2024 of both Amson Group, a Tanzanian Conglomerate and Savannah Clinker in relation to the sale of a majority stake in Bamburi Cement PLC which is publicly listed company.

Definitions and Overview

A merger or take-over is defined in section 41 of the Competition Act, 2010, as when one or more undertakings directly or indirectly acquire direct or indirect control over the whole or part of the business of another undertaking. This merger may be achieved through the purchase of shares or assets in an undertaking.

A competing take-over is defined as an offer made for an offeree’s voting shares, in response to an offer that has already been made by another person who is deemed to be the competing offeror. It occurs where 2 or more bidders make offers to acquire the same target company that is listed and is subject to an initial a take-over offer.

The take-over procedures provided in the Regulations apply to competing take-over offers however accounting for the situational differences between a Competing Take-Over offer and an Initial Take-Over offer. In view of the foregoing, below is a brief analysis of the take-over procedure as provided in the Regulations.

Procedures for Competing Take-overs.

i. Notice of Intention

The first step is the issuance of a notice of intention to acquire an undertaking. Regulation 4 provides that a company which intends to acquire effective control in a listed company (the offeror) shall not later than 24 hours from the resolution of its board to acquire effective control in the company announce the proposed offer by press notice and serve a Notice of Intention in writing of the take-over scheme. This Notice of Intention shall be to the proposed offeree, the securities exchange on which the offeree’s shares are listed, the Capital Markets Authority and the Competition Authority of Kenya.

Additionally, the Notice of Intention should contain the following information;

a. the identity of the proposed offeror;

b. the identity of the proposed offeree and the exchange at which its shares are listed;

c. the type and total number of voting shares of the offeree which are held directly by the offeror;

d. details of any existing or proposed agreement relating to the voting shares; and

e. the conditions of the take-over.

ii. Offeror’ Statement

Upon issuance of the Notice of Intention to the various parties. the offeror is additionally required to serve the offeree with an offeror’s statement of the take-over scheme within 10 days from the date of the Notice of Intention. The statement should be pre-approved by the Capital Markets Authority. Thereafter, the offeree ought to inform the relevant securities exchange, the CMA and make an announcement by a press notice of the proposed take-over offer within 24 hours of receipt of the offeror’s statement.

It is worthy to note that an offeror is allowed to amend or withdraw the offeror’s statement subject to the prior written consent of CMA.

iii. Take-Over Offer

The offeror is thereafter required to submit to the CMA the take-over offer document in relation to the take-over offer for approval. The take-over document should be issued within 14 days from the date of serving the offeror’s statement and contain information such as the identity of the ultimate offeror and offeror’s stated intentions regarding major changes to be introduced in the business.

The CMA is mandated to approve the take-over document within 30 days where it satisfies the requirements of the regulation.

iv. Service of the approved take-over document and circulars

According to Regulation 7(4) the offeror should serve the take-over document on the offeree within 5 days from the date of approval. Thereafter, the offeree is required to circulate this take-over offer document to its shareholders to whom the offer relates within 14 days from the date of receipt of the approved take-over document.

The documents should be accompanied by a circular indicating whether the Board of directors recommends the acceptance of the take-over offer and an independent adviser’s circular which should disclose all information that would be reasonably required to make an informed decision.

v. Closing of the Take-over offer

The offeror must keep an offer open for acceptance for a period of 30 days from the date the take-over document is first served. The take-over offer is deemed closed on the last day of the offer period. However, a shareholder may voluntarily withdraw acceptance any time before the closing of the offer.

vi. Announcement of Acceptance

Thereafter, the offeror is required to notify the CMA and the securities exchange within 10 days of closure of the offer. This is in addition to an announcement by way of press notice in at least 2 English dailies of national circulation particularizing the total number of voting shares to which the take-over relates and for which acceptance has been received.

vii. Transfer of Accepted shares

The offeree is mandated to ensure prompt transfer of the accepted voting shares to the offeror in the register of members maintained as required by the applicable laws.

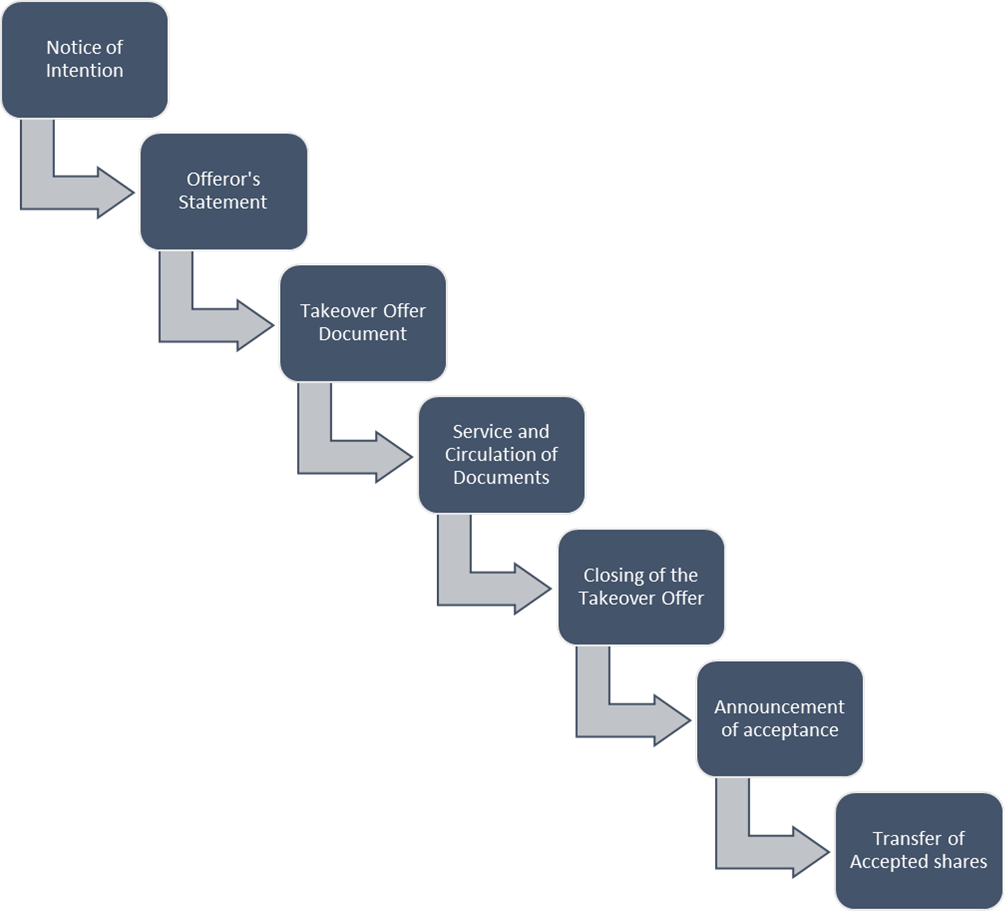

VISUALIZATION OF THE PROCEDURE FOR A COMPETING TAKE-OVER

Conclusion

In conclusion, the regulatory framework governing competing take-overs in Kenya, as outlined in the Capital Markets (Take-overs and Mergers) Regulations, 2002 provide a structured process aimed at ensuring fairness, transparency, and market integrity in Kenya. The step-by-step procedures, from issuing the notice of intention to the final transfer of accepted shares, underscore the emphasis on protecting shareholder interests and maintaining orderly transactions in cases of competing bids. This framework in the Regulations fosters a fair marketplace where investors can make well-informed decisions and strengthens investor confidence in Kenya’s capital markets.

Authored by Godwin Wangong’u and Co-Authored by: Jessica Opiyo and Peris Njonjo